How to revert Venezuela’s economy – Luis Enrique Gavazut

Gavazut, a respected thinker on Venezuelan history argues that a lack of transparency historically and actions provoked by local and international capitalists are at the heart of a crisis that has engulfed the oil-rich state since President Nicolas Maduro replaced deceased revolutionary leader Hugo Chavez.

VA: In your view, as an researcher and lecturer, what are the circumstances and causes that have led to Venezuela’s current economic crisis?

LEG: The situation in Venezuela over the last few years has been one of frank deterioration, due in part to the falling oil prices. That, in turn, contributed to a drop in the state’s hard currency revenues, which is key to satisfying the population’s needs.

To understand the Venezuelan economy, you must recognize that access to hard currency ultimately derives from one source only: the state. Historically, 95% of the hard currency revenues in Venezuela come from PDVSA, which is our country’s flagship corporation. The private sector does not generate hard currency, because the privately-owned part of the productive apparatus, at least the sector that is not based on oil or mining, is not oriented toward exports.

When we look at the economic sectors that are geared to the immediate satisfaction of the society’s needs, we see that there are huge difficulties. Levels of production, already small before the crisis, are dropping very rapidly. Right now, the national economy is operating at 22% of its installed production capacity and imports have fallen by 80% in recent years, which explains the shortages that we are facing today.

This means that there is a terrible recession.

But things haven’t always been this way. A few years ago, in 2013, when Nicolas Maduro took over as president right after the death of Hugo Chavez, things weren’t as they are today. What happened then is that the private sector, especially foreign and large national capital, took the decision as a bloc to begin an economic war against the country. What was their objective? Toppling the government.

In other words, the most powerful economic actors in our country began to operate according to a political logic rather than an economic one. Evidence of that was their decision to slow down production and the decision to divest. In other words, since 2013 they began to take steps which affected the supply of goods in Venezuela, which we have come to call “induced shortages.” This is a real phenomenon that has happened here in Venezuela, and it is an important factor in the crisis.

In the face of this, the Bolivarian government attempted to sustain people’s purchasing power by increasing salaries and maintaining the social programs. That propped up a robust demand for goods and services for a while, but the private sector had already decided to cut off supply. Of course, when you have robust demand and reduced supply, that leads to serious disequilibrium, and prices begin to climb very rapidly.

VA: What you have said so far focuses on the politically-driven causes of the crisis. However, there are other factors. Venezuela has large debts and in recent years the burden of payments has become quite heavy. Additionally, the country finds itself less and less able to borrow money and the oil prices have been notably unstable. This reduces the supply of hard currency for imports or social programs, unless the government were to default on the debt in a systematic way, as Argentina and Ecuador did very successfully earlier in the century. How do you evaluate these factors?

LEG: The scarcity of hard currency is key to understanding the Venezuela’s current situation. When the state cannot offer foreign currency in the local exchange market, the whole economy gets out of whack, since this is an economy that was shaped by the oil rent for decades. It is so not only in the public sector, but also in the private sector. It affects imports of consumer products, means of production, and intermediate goods. State imports that are directed at non-private distribution systems have shrunk too.

At the same time, we are witnessing a precipitous drop in PDVSA production, which is the consequence of a series of bad decisions in the industry: policy makers imagined that the oil bonanza was going to last many more years, and thus there were enormous investments made in the Orinoco Oil Belt, which is where Venezuela has giant long-term potential for heavy oil production.

What happened? All those investments went only half way and still require enormous volumes of capital. On top of that, while these investments were being made, there was a flagrant disregard for the maintenance of light and medium wells in Zulia and Anzoategui. That is where our production should be focused now, since lighter oil is more easily extracted and sold on the international market.

The fall in oil prices and the drop in production left PDVSA, which had acquired a huge debt precisely to make investments in the Orinoco Oil Belt, in a precarious condition. In the face of that situation, the company began to have problems meeting the terms of the debt. This put us in an emergency situation, where we need financing to recover the economically-viable wells, the ones that produce light and medium grade oil. But most of the doors that extend credit are closed. It is this vicious circle in which the oil industry currently finds itself.

VA: You have criticized the Economic Recovery Plan that President Nicolas Maduro launched in August. Can you explain your main arguments?

LEG: The Economic Recovery Plan is based on a series of theoretical premises that, from my point of view, are false. That is why it hasn’t worked and won’t work. The first problem is the monetarist theory of inflation on which it is based, which simply does not apply here.

Basically, we have here is a severe contraction of the economy, a very profound recession. The premise of the monetarist theory is that if demand is reduced by decreasing liquidity, then consumers won’t have money to pay for goods and services, and that, in turn, will bring prices down.

But in the Venezuelan case, all that policy will do is close the stores, which means even more recession! Factories, stores, supply centers – much of what was still in business – have been shutting their doors at a rapid pace since August 20, when the Economic Recovery Plan was announced.

To maintain what there is of economic activity in Venezuela and to preserve the enterprises that still operate, it is imperative that there be some demand. That means that the minimum salary must go up periodically, social programs and direct support to the working class through bonuses must be maintained (direct and indirect subsidies must stay!). It is the government’s role to continue doing this.

In other words, proposing a recovery plan with the main objective of zero fiscal deficit and the contraction of monetary liquidity by limiting the emission so-called “inorganic” or unbacked money, that is a solution that won’t work here and now.

In fact, when faced with this situation, the state was obliged to adjust its own policies through a salary hike, just ninety days after the plan was announced!

VA: There is another aspect to the Economic Recovery Plan that was announced last year, which is the incentive to private investment. Is it working?

LEG: From my point of view, that part of the plan is also quite problematic. Those who designed the plan seem to think that giving incentives to the private sector will generate a favorable reaction from businesspeople. Having received these incentives, the private sector will (so their thinking goes) invest and increase production. Private investment, in turn, will lead to economic stability.

The theory behind giving incentives to the private sector in Venezuela doesn’t work here as it might work in other economies. Here we have the most favorable exchange rate in the world and the cheapest labor in the world. Now labor is actually free since, since August 20, the state is paying wages of private sector workers! In other words, if you come here and you set up a business, the state will pay the salaries of the workers. This is something that has never happened before. With this we pass into the annals of economic history! To top it all off, the economic recovery package eliminated import tariffs.

So the country offers all this which, in principle, should attract a great deal of private investment. But it’s not only that: here taxes are very low and they aren't progressive (leaving aside the fact that there is a huge tax evasion, which has been the case for a long time). Venezuela has also the cheapest energy, the cheapest gas, the cheapest electricity, and the cheapest running water in the world. Then, on top of that, you can add all the comparative advantages that Venezuela has, from climate to location (proximity to the US).

In other words, Venezuela is a paradise for private investments if we follow the incentives theory and the theory of comparative advantage. And yet the private sector hasn’t invested here!

How do orthodox economists explain this situation? They say that there is no legal security. That is the classical argument. But it turns out that in Maduro’s presidency there hasn’t been one single expropriation! The politics of expropriations and nationalizations ended with President Chavez. For six consecutive years, there hasn’t been one single expropriation, and this government has no intention of doing it ever again. In fact, a year ago the National Constitutive Assembly passed the Foreign Investment Law, one of the most servile and “deterritorialized” laws in the world. Additionally, Venezuela has special economic zones which offer incentives of all sorts to private investors, including guarantees of legal security.

So, obviously, the problem isn't legal insecurity, nor does the solution lie in giving more and more incentives to the private sector. Recently, a Chinese functionary spoke to top government leaders on public television here, and he declared that they have a robust private sector [in China], because the Chinese government gives incentives to that sector. Maybe that has worked in China, but in Venezuela the theory doesn't apply.

The only way to stimulate the Venezuelan economy is [increasing] the oil rent. It is the only thing that works. We can look at this historically, and we will see an exact correlation: to the degree that the oil rent grows – and thus the supply of hard currency in our exchange market rises – then we see increased installed production capacity and some investment taking place, both national and foreign. But this happens only during an economically expansive period!

In the recessive period of the cycle, when oil revenues shrink, the state cannot offer subsidized dollars. Then we immediately see divestment, closing of factories and other enterprises, and not only private ones but also public enterprises. This is what is happening now.

By the way, here we come to an issue that is often misinterpreted. Common sense says that an enterprise, because it is public, will be less efficient than its private counterpart. That is totally false! For instance, in Venezuela today both public and private enterprises are inefficient, on the border of collapsing if they haven’t done so already. That is happening [to both] because there is no oil rent.

Yet the moment that hard currency comes into the state’s coffers, then the economy will come back to life.

Let’s look at the case of Lacteos Los Andes, which is a state dairy enterprise that has come to a halt. You can be sure that, if the revenue from the oil profits go up again, then we will see its production get back in gear, and their products will reappear on the market. It’s just the same with a private, international corporation, such as Goodyear, which recently closed operations in Venezuela. Goodyear stated that it pulled out of Venezuela because it cannot operate here. But if the oil rent goes up again tomorrow, then you will see Goodyear reopening its plants!

Think of it this way: the biggest inefficiency possible in an enterprise is for it to cease operations. If we see it that way, then both Goodyear, a private corporation, and Lacteos Los Andes, a state-owned industry, are equally inefficient.

VA: Can you explain Venezuela’s role in the global economy, as an oil producer, and the kinds of problems that this sometimes leads to?

LEG: Venezuela is a rentier economy. We don’t develop our own science and technology. Obviously, this situation makes us economically dependent on hard currencies [to get access to foreign technology].

Why does the private sector not invest in Venezuela when the revenues from the oil rent shrink? Because investment here happens in hard currencies. In other words, a private investor expects to get his earnings in dollars, because he earlier purchased technology, machinery and other inputs with dollars (although generally subsidized by the state). Thus he expects to recover the investment in dollars…

For this reason, the investor says, well, if in this economy the access to dollars becomes very limited, then I’m just not going to invest in Venezuela. That is why, when the oil rent recovers, when we are in the expansive phase of the economy, when the oil boom happens, the investors come back since they know that dollars will be made available by the state...

Why is it that private investors don’t generate dollars, as is the case in other countries? Because when the design of globalization took shape, Venezuela was not planned as a base for exporting. Procter & Gamble, for instance, made export platforms in Mexico, in Brazil, and in Argentina, and smaller platforms in Colombia and Panama, but that didn't happen in Venezuela. Venezuela is not considered a base for exports with the exception, of course, being oil exports. So Procter & Gamble is not going to set up a plant to produce here, as it would be competing with itself. Some countries are bases for exploitation of workers employed in export industries, whereas others are simply sites for extracting rent. In this case, Venezuela is a country whose role is to generate rent.

VA: What solutions do you propose for Venezuela’s quandary?

LEG: There are three steps that must be taken. First, the state must make productive investments. The Venezuelan state cannot avoid taking on this role. That means, like it or not, that Venezuela’s economy must be socialist. Given our conditions, if Venezuela is to come out of the current crisis, it will only happen by taking the path to socialism. President Chavez reached that conclusion when he said that the only possible path for the Venezuelan economy is socialism.

What is socialism? Well, the state must invest in means of production instead of stimulating private investment. Instead of offering subsidized dollars, the state needs to establish state manufacturing plants in association with organized communities, with the communes. This is key: joint projects in which the state and organized communities work together.

The other option would be to continue limping along with the bourgeoisie, courting private investors with incentives that are totally inefficient. To continue insisting on that course would be demented! It would be like traveling a well-known path once again and expecting to arrive at a totally different destination!

The second step is in the area of macroeconomic measures. We need to stabilize the exchange rate in Venezuela. To do this, from my perspective, there must be two strategies.

The first one is to totally liberalize the currency exchange market in Venezuela. The point of doing that is to attract the legal sale of hard currencies that are now arriving to the country through remittances, or of the dollars in the hands of small exporters of goods and services. Those dollar revenues, which are under ten billion a year, could be very important for our economy. Drawing off the dollars that now enter into the parallel market and allowing those transactions to happen in a legal, formal, public, transparent market, that would be a step forward. That is only going to happen by eliminating the exchange controls.

Now we have an exchange market that is legal but is totally useless: the DICOM market. Arguably, it’s a market that is fake, because it doesn't attract dollars, and it doesn't offer them either. In other words, [my proposal is to] convert the current parallel market, which is the real benchmark for transactions carried out in Venezuela, and turn it into a transparent market. That would be a way to stabilize the exchange rates.

The other [important strategy] is to generate conditions for the correct functioning of the Petro, as a financial asset that is fungible in the market, in other words, an asset that can be easily exchanged for other currencies and with competitive transaction costs. Unfortunately, the Petro does not obey this logic. That is why the Bolivar‐Petro anchoringfailed as evidenced by the recent 150% devaluation. The anchoring didn’t work because the Petro has no [real] life as a financial asset right now. If this were to happen, and it can happen if the correct decisions are taken, then the Petro could become an important tool [for recovery].

VA: In the realm of macroeconomics you suggest liberalizing exchange rates plus a Petro that functions as an exchangeable asset. You also argue for state investment in productive projects in collaboration with organized communities. Those are the first two steps that you recommend. What is the third?

LEG: It’s urgent to rescue PDVSA. I believe that all the state’s efforts, all of its resources, must be channeled towards PDVSA. The recovery of the oil company’s production levels must be the focus of our economic policy now. With every dollar that comes in, we must evaluate the effect if it is invested in PDVSA versus another kind of use in the economy. The state should channel all available resources in dollars in human potential, etc. to raise the production levels of PDVSA.

In other words, there shouldn't be a dispersion in other Productive Motors that in this moment are totally useless since they aren’t going to bring dollars into the economy. Our primary focus should be PDVSA, and also perhaps include the mining sector as part of our main concerns. That sector may be necessary in our crisis despite being really a disaster, because of the environmental impact, the loss of sovereignty that comes with it, and the destruction that it brings to indigenous communities.

In other words, we need a new monetary policy, we need a state committed to the developing of productive forces with the participation of organized communities, and we need to recover PDVSA’s production.

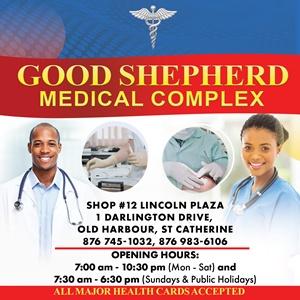

Old Harbour News is a community-based online news media outlet based in Jamaica with more than 300,000 unique visitors since 2013. However, we are soliciting your support to continue provide independent journalism and unique stories tailored just for you. Your contribution, however small it may be, will ensure our service to you remain independent and grow to serve you better. Click the DONATE BUTTON now to support Old Harbour News. Thank you.