Burna Boy, Joseph M. Matalon, DBJ among investors in Jamaica’s first venture capital in 30 years

Mscale is a Delaware-based management company, focused on venture and permanent capital advisory services. Ugo Ikemba serves as the chief executive officer of Mscale and brings over 20 years of experience in venture capital and private equity expertise with a focus on early-stage companies. He has been involved in the raising and deployment of four funds totalling over US$300 million for deals in sectors such as technology, tourism, and hospitality, fintech, banking, building materials, agribusiness, logistics, and manufacturing.

In making the announcement David Wan, acting managing director, DBJ, stated: “The investment in a VC Fund at this time is not only opportune but a welcomed addition to Jamaica’s financial offerings to early-stage companies. The provision of alternative sources of financing for businesses outside of debt, is part of the DBJ’s focus on ensuring economic growth and development for all Jamaicans. This VC fund is trailblazing for DBJ in that it fills a gap in our portfolio for equity investment into early-stage companies. Previous funding activities include innovation grants, supply chain grants, loans, and private equity for SMEs. This new Fund will expand the DBJ’s suite of products, to underscore our mission to be a ‘Business Builder’ within our country.”

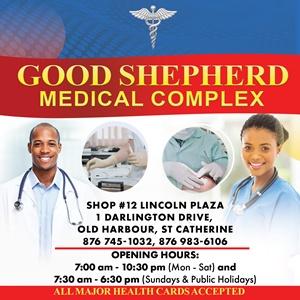

The VC Fund’s strategy and thesis will revolve around tech and tech-enabled firms focusing on four key pillars – Financial Services; Entertainment; Agribusiness; and Health. The underlying sectors to the pillars include manufacturing; tourism; sports; retail; digital health; renewable energy; mobility; fintech; e-commerce; agritech; logistics; and business services. The Fund will employ technical assistance where necessary to enhance selected deals. The team consists of diverse professionals with strong track records in transactions in the Caribbean, Africa, and North America. Investments in firms will be in the form of equity and quasi-equity.

Christopher Brown, programme manager, BIGEE (Boosting Innovation Growth and Entrepreneurship Ecosystem), under whose portfolio the VC Fund is being established explains, “The Fund has achieved its first close at US$15M with seed funding of US$4.9M from the DBJ. The total capital is projected to grow to US$50 million, targeting investments in top early-stage firms across Jamaica and the Caribbean. These firms will offer high-demand products or services that can be easily accessed worldwide.”

The close consisted of four investors from the Caribbean and Africa. They are the DBJ; PanAfrican Capital Holdings; Jamaican investor and businessman Joseph M. Matalon, and Spaceship Collective (a company owned by Afrobeats global star Burna Boy). Mscale is confirming that the fund-raising process is ongoing.

“The Mscale team is both humbled and honoured to have achieved its initial close with seed funding from the DBJ. We are focused and committed to intelligent investing through leveraging the team’s deep local insight and global VC expertise. The positive macroeconomic conditions of Jamaica and other Caribbean countries coupled with the VC financing gap present an unprecedented opportunity to help the top tier early-stage firms scale into global champions” stated Ugo Ikemba, CEO of Mscale.

Old Harbour News is a community-based online news media outlet based in Jamaica with more than 300,000 unique visitors since 2013. However, we are soliciting your support to continue provide independent journalism and unique stories tailored just for you. Your contribution, however small it may be, will ensure our service to you remain independent and grow to serve you better. Click the DONATE BUTTON now to support Old Harbour News. Thank you.